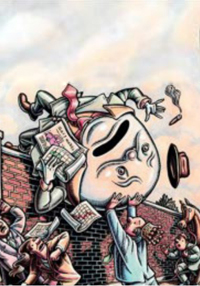

Sri Lanka has been driving post-war growth in boom and bust cycles on the trade deficit; and fiscal measures have been used, especially spending on construction, to offset the bust cycles. This strategy is now being squeezed to pulp and it is not sustainable going forward.

“In the context of growing bilateral relations with India, this study by Verité Research takes a look at the current status of Sri Lankan exports to India under the existing India – Sri Lanka Free Trade Agreement (ISFTA). The study identifies Non-Tariff Barriers to be a critical factor in the lackluster performance of exports to India in recent years. The case of food exports serves to highlight how compliance with Indian standards and regulations forms one such significant barrier, due to India’s non-recognition of testing and certification conducted outside its borders. The proposed solution to this problem – a Mutual Recognition Agreement – is one that is easily implementablewhich will help exporters enjoy the full benefits of duty concessions offered by the ISFTA and if done right, will help build confidence in the benefits of further integration.”

“In the context of growing bilateral relations with India, this study by Verité Research takes a look at the current status of Sri Lankan exports to India under the existing India – Sri Lanka Free Trade Agreement (ISFTA). The study identifies Non-Tariff Barriers to be a critical factor in the lackluster performance of exports to India in recent years. The case of food exports serves to highlight how compliance with Indian standards and regulations forms one such significant barrier, due to India’s non-recognition of testing and certification conducted outside its borders. The proposed solution to this problem – a Mutual Recognition Agreement – is one that is easily implementablewhich will help exporters enjoy the full benefits of duty concessions offered by the ISFTA and if done right, will help build confidence in the benefits of further integration.”

මෙම සියවස ආරම්භයේ සිට ශී්ර ලංකාවේ අපනයන එහි දළ දේශීය නිශ්පාදිතයේ ප්රතිශතයක් ලෙස පමණක් නොව ගෝලීය අපනයනවල ප්රතිශතයක් ලෙස ද, පහත වැටී තිබේ. නිදහස ලැබුණු වකවානුවේ දී, වර්තමානයට වඩා ඉහළ ගෝලීය වෙළදපොළ කොටසක් අත්කර ගැනීමට ශී්ර ලංකාවට හැකිව තිබුණි. මෙම අධ්යනය ශී්ර ලංකාව මෙතෙක් කල් මුහුණපා ඇති බාධක මැඩපැවැත්වීමට සහයෝගයක් ලබාදිය හැකි ප්රතිපත්ති යෝජනා හදුනාගැනීමට දරණ ප්රයත්නයකි.

This Insight analyses the importance of export finance as a tool to facilitate and promote exports in Sri Lanka. It identifies the bottlenecks that prevent effective use of export finance in the country and provides recommendations to improve availability, access and effective utilisation of export finance in the country.

This study examines the status of the export finance market in Sri Lanka and identifies the key limitations that prevent export finance from playing a proactive role in promoting exports. It reveals that the access, availability and diversity of export finance in Sri Lanka is limited and the few export finance solutions that are available remain weak and under-utilised. Export finance solutions reduce the risks faced by exporters such as country and commercial risks, encourage diversification into developing country markets, helps SMEs manage short term cash flow issues and allows exporters to attract buyers by offering better payment terms. By doing so, export finance can help promote exports.

This study examines the status of the export finance market in Sri Lanka and identifies the key limitations that prevent export finance from playing a proactive role in promoting exports. It reveals that the access, availability and diversity of export finance in Sri Lanka is limited and the few export finance solutions that are available remain weak and under-utilised. Export finance solutions reduce the risks faced by exporters such as country and commercial risks, encourage diversification into developing country markets, helps SMEs manage short term cash flow issues and allows exporters to attract buyers by offering better payment terms. By doing so, export finance can help promote exports.

Measures to prove compliance with an importing country’s standards and regulations are necessary for all exports. However, Sri Lankan exports to India suffer greatly from the associated costs and delays. This Insight proposes a Mutual Recognition Agreement (MRA) in Conformity Assessment Procedures (CAPs) to overcome this barrier and encourage further trade between Sri Lanka and India.

In February 2015 the Central Bank of Sri Lanka called an auction for one billion rupees on a 30 year bond. It then accepted 10 fold – 10 billion rupees – after the bids were in. This Insight identifies three errors in the published calculation of the monetary loss, and recalculates it at 0.9 billion rupees. It also highlights two other issues: conflict of interest, and confidence in institutions, which add to the negative consequences of the Central Bank decision.